Payment Solutions for Digitizing Cash Flows

Business Model Description

Develop digital platforms (P2P / P2B / B2B) offering convenient payments and financial services, along with access to secure payments, transfers, cash-in/out, rewards, asset management, and investments, reward points based incentive.

E-wallet based payment solutions can be offered to serve low-income population by offering affordable cross border remittance solutions for immigrants, and business value chains by offering P2B and B2B payment solutions. Examples of some companies active in this space are:

PT Visionet Internasional, founded in 2017, offers OVO, an e-wallet which allows users and businesses to make and collect payments (38% market share). In 2021, Grab Holdings Inc. acquired stake from Lippo Group and PT Tokopedia to expand its ownership in OVO to ~90%. (17) In 2019, it was valued at USD 2.9 bn, making Grab's purchase worth USD 500 mn to USD 1 bn. (18 and 19)

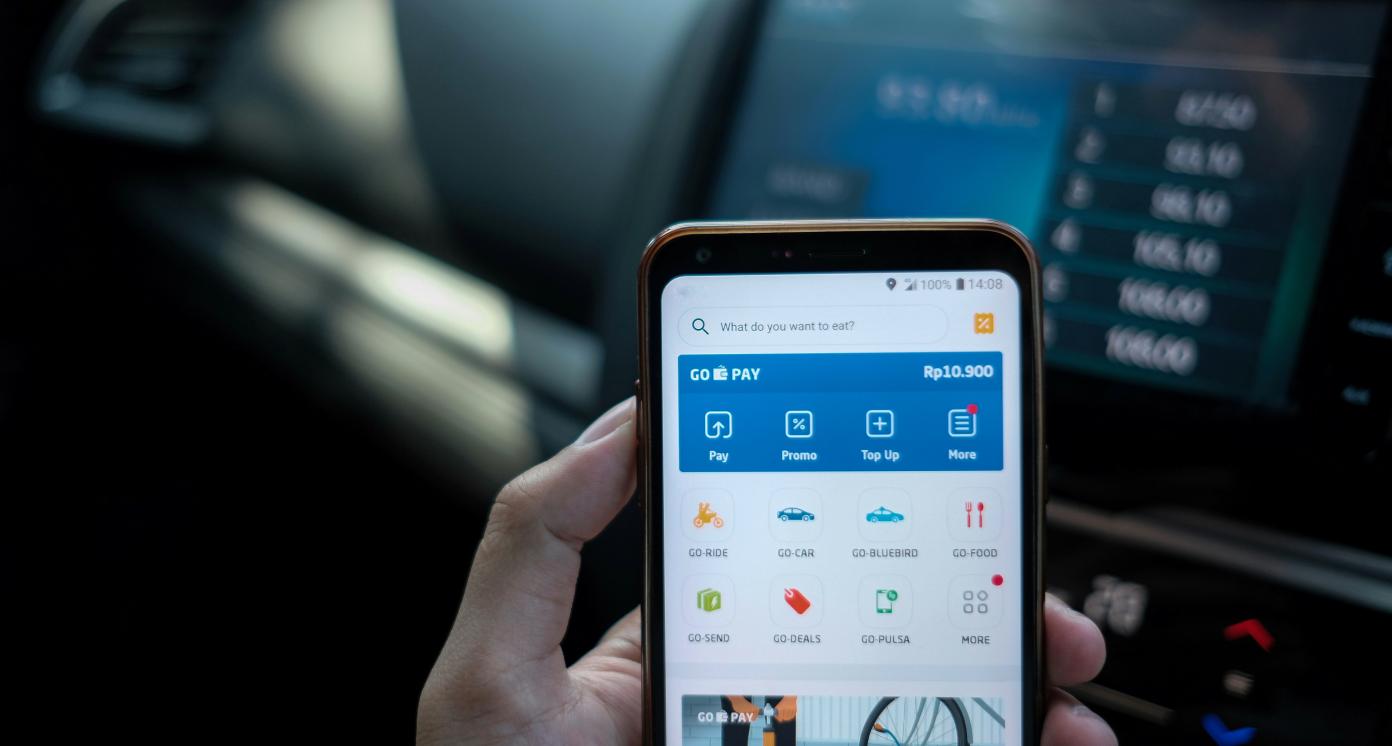

GoPay was founded in 2010 as an e-money wallet for Gojek services. With >1 mn users, it helps in facilitating transactions to enable Gojek create millions of jobs for its service providers (motorcycle drivers, food stall owners and the like). In 2020, Facebook and PayPal invested in Gojek, resulting in their 2.4% and 0.6% stake, respectively, in Gojek’s GoPay fintech arm. (20)

Expected Impact

Easy money transfers by low-income groups, retail customers and businesses beyond urban areas, ensuring better transparency of transactions

How is this information gathered?

Investment opportunities with potential to contribute to sustainable development are based on country-level SDG Investor Maps.

Disclaimer

UNDP, the Private Finance for the SDGs, and their affiliates (collectively “UNDP”) do not seek or solicit investment for programmes, projects, or opportunities described on this site (collectively “Programmes”) or any other Programmes, and nothing on this page should constitute a solicitation for investment. The actors listed on this site are not partners of UNDP, and their inclusion should not be construed as an endorsement or recommendation by UNDP for any relationship or investment.

The descriptions on this page are provided for informational purposes only. Only companies and enterprises that appear under the case study tab have been validated and vetted through UNDP programmes such as the Growth Stage Impact Ventures (GSIV), Business Call to Action (BCtA), or through other UN agencies. Even then, under no circumstances should their appearance on this website be construed as an endorsement for any relationship or investment. UNDP assumes no liability for investment losses directly or indirectly resulting from recommendations made, implied, or inferred by its research. Likewise, UNDP assumes no claim to investment gains directly or indirectly resulting from trading profits, investment management, or advisory fees obtained by following investment recommendations made, implied, or inferred by its research.

Investment involves risk, and all investments should be made with the supervision of a professional investment manager or advisor. The materials on the website are not an offer to sell or a solicitation of an offer to buy any investment, security, or commodity, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction.

Country & Regions

- Indonesia: Countrywide

Sector Classification

Financials

Development need

Since COVID-19, banks adopted a more conservative approach for lending to MSMEs, resulting in a decline in the number of MSME credit accounts (4.20%) with the sharpest decline in the number of Micro credit segment. (1) People in remote locations and those with low income (limited savings) mostly rely on informal sources for financial services. (2)

Policy

Financial Services Authority's (OJK) 2nd pillar of Structural Framework 2021-2025 focuses on the development of financial services ecosystem by increasing the role of FSS in supporting priority economic sectors, MSMEs, job creation and regional development, including directing all FSIs to expand services to MSMEs (especially in remote rural areas). (3)

Gender inequalities and marginalization issues

Indonesia has >22 mn female entrepreneurs, and majority of them face significant difficulties in accessing financial services (particularly bank loans), which limits the expansion of their businesses. (4) 51.4% women (vs. 46.2% men) have bank accounts.

80% female labor force is employed in informal sectors and millions of women lack access to financial services to address their particular needs. (5) Limited access to capital makes people living in rural areas even more marginalized. (6)

Investment opportunities introduction

Indonesia is home to 20% of all fintech companies in Southeast Asia which are expected to generate USD 8.6 bn in revenue over the next 5 years (by 2026). (7)

Access to e-money encourages urbanization by reducing transaction costs for remitting. 26% urban and 22% rural population uses digital financial services for online shopping (8).

Key bottlenecks introduction

Major issue tends to be readiness of players to comply with licensing requirements with new and constantly changing regulatory frameworks. Various business models of FinTech lending players result in differing capabilities, infrastructure setup, and needs.

Lack of financial literacy has trapped many consumers into an ecosystem of illegal P2P lending. (9)

Corporate and Retail Banking

Development need

51% adult population (95 mn; most in regions outside Java) are unbanked.(10) Most households without financial access live in rural areas and in provinces outside Java with sparse internet connectivity and rely on manual remittances. E-wallet usage (63.6 mn users; 25.6% of population) is low and is predicted to reach 202 mn users by 2025. (11)

Policy

Bank Indonesia constructed Indonesia Payment System Blueprint 2025 with the aim to build a digital economy financial configuration to support the economic empowerment of the community and to ensure open access to digital data in a framework of adequate protection and governance (12).

Gender inequalities and marginalization issues

Even though 51% of women in Indonesia have bank accounts (compared to 46% men), (11) only 19% are financially literate. (14)

Investment opportunities introduction

In 2020, the number of Indonesia's migrant workers (PMI) was recorded at 3.19 mn people with remittances of USD 9.43 bn (0.86% of GDP) (15). As of 2018, Indonesia was APAC’s most valuable untapped e-money market as 66% of its population is “unbanked” (don’t own a bank account) and only 11% of its e-money app users are regular users (16).

Key bottlenecks introduction

The raise in the financial inclusion index has not been followed by a balanced increase in the financial literacy index. Meanwhile OJK's regulatory sandbox may discourage innovation in fin-tech.

Consumer Finance

Pipeline Opportunity

Payment Solutions for Digitizing Cash Flows

Develop digital platforms (P2P / P2B / B2B) offering convenient payments and financial services, along with access to secure payments, transfers, cash-in/out, rewards, asset management, and investments, reward points based incentive.

E-wallet based payment solutions can be offered to serve low-income population by offering affordable cross border remittance solutions for immigrants, and business value chains by offering P2B and B2B payment solutions. Examples of some companies active in this space are:

PT Visionet Internasional, founded in 2017, offers OVO, an e-wallet which allows users and businesses to make and collect payments (38% market share). In 2021, Grab Holdings Inc. acquired stake from Lippo Group and PT Tokopedia to expand its ownership in OVO to ~90%. (17) In 2019, it was valued at USD 2.9 bn, making Grab's purchase worth USD 500 mn to USD 1 bn. (18 and 19)

GoPay was founded in 2010 as an e-money wallet for Gojek services. With >1 mn users, it helps in facilitating transactions to enable Gojek create millions of jobs for its service providers (motorcycle drivers, food stall owners and the like). In 2020, Facebook and PayPal invested in Gojek, resulting in their 2.4% and 0.6% stake, respectively, in Gojek’s GoPay fintech arm. (20)

Business Case

Market Size and Environment

> USD 1 billion

5% - 10%

56% of payments are now made digitally (26) E-wallet usage-202 mn users by 2025. (13)

Indonesia received USD 7.2 bn in remittances from 6.5 mn migrant workers, making it the 3rd largest remittance recipient in the Asia-Pacific region, with 80% of migrant workers being women. (24)

Gojek and GoTo (Gojek merged with Tokopedia to form GoTo Group, an USD 18 bn giant) financial ecosystems are expected to contribute USD 17.6 bn, i.e. 1.6% of Indonesia's GDP, to the national economy in 2021. (25)

Digital Payments is likely to be the biggest contributor to the growth of Indonesia's FinTech industry with a total transaction value of USD 64,741 mn in 2022. Number of users in this segment are expected to amount to 221.07 mn users by 2025. (26)

Indicative Return

Gopay: (27) Gross transaction value [GTV] in 2020 grew by 10%, significantly surpassing its pre-Covid-19 levels. (25) Total transaction value in 2019 - USD 6.3 bn (supported by GoRide and GoFood) total Gojek transactions (2020) - USD 12 bn

OVO reported: (23) - 19x increase in revenue supported by 12x increase in its users by 2019. [User transactions to pay for logistics needs using OVO grew by ~40%. (28)] - 19x increase in total purchased value (TPV) supported by 8x increase in the amount of funds raised

Private Equity firms target 20-25% IRRs on their investment. Returns depend on stage of investment and the valuation at the time of exit. Example: Seed fund investors will earn a better return if they hold their investment, than the investors who enter at a later stage.

Investment Timeframe

Short Term (0–5 years)

OVO was established in 2017 and became a unicorn in 2019, implying a short pay-back period for e-wallet players. (18)

Ticket Size

> USD 10 million

Market Risks & Scale Obstacles

Impact Case

Sustainable Development Need

Promoting technological know-how would enable consumers to enjoy easy access to financial technology, thereby resulting in deepening of financial inclusion through growth in digital payments which is a key pillar in ensuring sustainable and entrenched digital finance-driven growth. (25)

Gender & Marginalisation

Promote financial inclusion by equipping users with easy payment platforms. 1/5 users are newly exposed to payment products / banking services after using GoPay. 56% of GoPay users have an increased understanding of digital payments, while 45% have started using e-wallets more frequently. (25)

Promote economic and financial inclusion of women by providing accessible modes of payment. 76% of GoSend social sellers, 42% of GoFood merchants, and 39% of GoPay merchants are women. (33)

Provide secure, efficient and low cost remittance solutions for migrant workers who generally come from low-income families in rural areas with limited access to formal financial services. (24) This measure could also improve transition to accessing more complex financial services.

Expected Development Outcome

Increase in contactless electronic money transactions with GoI's support. The number of MSMEs on the OVO platform grew by 95% during 2020 with acceleration in the second half. This is an indication that MSMEs are seeing real benefits to their businesses from digital (34)

Introduce users to the ease of payments with electronic money. Example: 1/5 GoPay consumers are unbanked or underbanked and GoPay is their first exposure to using a digital financial product. (25)

Improve payment acceptance in business value chains [B2B] by promoting greater acceptance of digital payments at merchant points [P2B].

Gender & Marginalisation

Reduce entry barriers for micro-consumers (including underserved groups) into formal financial services.(24) E-wallet providers and pay later products provide accessible financial services especially for the underbanked people both in the urban and rural areas (24).

Encourage the presence of more female talent for careers in the fintech industry by collaborating with industry players and offering funding support for female entrepreneurs. 77% FinTech companies claim it is easier to find male talent than women talent. (30)

Increasing speed and transparency and reduce costs associated with providing access to financially underserved communities through the use of tech-enabled payment platforms. (35)

Primary SDGs addressed

8.10.1 (a) Number of commercial bank branches per 100,000 adults and (b) number of automated teller machines (ATMs) per 100,000 adults

8.10.2 Proportion of adults (15 years and older) with an account at a bank or other financial institution or with a mobile-money-service provider

Number of commercial bank branches per 100.000 adults: 14.16 in 2012; 17.67 in 2020 Number of ATM per 100.000 adults: 35.73 2012; 52.95 in 2020 (36)

51% of females above 15 years age own a bank account. 35% of individuals above 15 years age made or received digital payments in the past year (Global Findex database, 2017) (37).

ATM (per 100k people, in units): 56.3 units in 2021, 56.7 units in 2022, 57.1 units in 2023, 57.5 units in 2024 Branch (per 100k people, in units): 15.4 units in 2021, 15.3 units in 2022, 15.3 units in 2023, 15.3 units in 2024 (35)

Not available as on January-2022

Secondary SDGs addressed

Directly impacted stakeholders

People

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Indirectly impacted stakeholders

Gender inequality and/or marginalization

Planet

Corporates

Public sector

Outcome Risks

Potential cyber attack (system's vulnerability to customer data theft and abuse) can impact the economy adversely with leakage of private customer information and confidential government data (24)

Benefits of digital solutions can only be enjoyed by the section of population that owns a mobile phone and has efficient internet connectivity.

Businesses that do not have access to payment infrastructure, like QR codes, POS machines, web based payment solutions, may remain excluded.

Gender inequality and/or marginalization risk: Increased consumerism resulting from easy payment options may result in decrease in savings behaviors at the end consumer level.

Impact Risks

FinTech solutions call for a reasonable degree of digital awareness and literacy, and may leave less digitally savvy groups out of the fold of such services, thereby limiting inclusiveness of population.

Data breaches, fraudulent transactions can be an issue if adequate consumer education and protection measures are not in place.

Regions with restricted internet connectivity will not be able to reap the benefits of digital payment solutions.

If the payment app is not tweaked to suit the digital capabilities of low income segments, the solution may scale only to the urban, middle-high income segments (that is already adequately served).

Gender inequality and/or marginalization risk: Lack of regulation and control, accompanied with lack of awareness about grievance registration may result in exploitation of underserved population.

Impact Classification

What

Provide affordable and convenient mode of digital payments with focus on underserved population

Who

Underserved; Unbanked population benefits from the ease and affordability of making remittances; Population at large benefits from the convenience of transacting

Risk

Utilization of digital technology without adequate customer protection measures may expose customers to cyber crime/fraud.

Contribution

As per Bank Indonesia's IPS Blueprint 2025, ratio of adult participation rate in the financial sector increased from 32.3x in 2019 to 55x in 2025 (12).

How Much

60% of Indonesia's population is unbanked (38) and 60% population owns a mobile phone (39). 56% of payments are made digitally. (40)

Impact Thesis

Easy money transfers by low-income groups, retail customers and businesses beyond urban areas, ensuring better transparency of transactions

Enabling Environment

Policy Environment

The 2021-2021 MPSJKI is directed at enhancement of the FSS resilience and competitiveness through strengthening resilience and competitiveness, financial services ecosystem development, and digital transformation acceleration. (3)

Structural Framework 2021-25: FSS resilience/competitiveness is carried out through strengthening capital and consolidation of FSI; strengthening governance, risk management and market conduct; aligning regulations with international standards; and cross-sector supervision (3)

FSS ecosystem development is carried out through increasing FSS role in supporting priority economic sectors, MSMEs, job creation, and regional development; development of sharia finance; expanding financial access and literacy; strengthening consumer protection. (3)

Digital transformation acceleration is carried out through FSS digital innovation; regulatory framework to support digital financial ecosystem; improving human capital; implementation of IT-based supervision in OJK; business process reengineering (3).

Financial inclusion is accelerated through several strategies such as increasing access to formal financial services, increasing literacy and consumer protection, strengthening MSME's access to capital and development, and improving digital financial products and services (41).

Financial Environment

Fiscal incentives: Fiscal incentives include import duty exemption; corporate income tax reduction; gross income reduction facility for R&D, implementation of work practices, and apprenticeships; and net income reduction (45).

Other incentives: Non-fiscal facilities include recommendation to change the status of: a visit stay permit to a limited stay permit and a limited stay permit to a permanent residence permit (45).

Regulatory Environment

In supporting non-cash transactions, BI has issued several regulations such as Bank Indonesia Regulation (PBI) No.18/17/PBI/2016 concerning Electronic Money and Bank Indonesia Regulation (PBI) No.19/8/PBI/2017 concerning National Payment Gateways. (42)

BI has also reformed the payment system regulation through the issuance of Bank Indonesia Regulation No.22/23/PBI/2020 concerning Payment Systems (Bank Indonesia Regulation Payment Systems). (42)

Indonesia Payment Systems Blueprint 2025 is cascaded into five initiatives, namely Open Banking, Retail Payment Systems, Financial Market Infrastructure, Data, and Regulatory, Licensing, and Supervisory. (12)

Bank Indonesia Regulation concerning the Implementation of Payment Transaction Processing (PBI PTP) includes licensing and approval in the operation of payment transaction processing and the operator in processing payment transactions. (44)

Regulated Payment System Service Providers include Fund Transfer Providers and Electronic Wallet Operators. Principals, Switching Providers, Clearing Providers and Final Settlement Providers must be a limited liability company with at least 80% shares owned by Indonesian entities.(44)

Marketplace Participants

Private Sector

Corporates: PT Atome Finance Indonesia, PT Visionet Internasional (OVO), PT Dompet Anak Bangsa (GO-PAY), PT Lunaria Annua Teknologi (KoinWorks) Investors: Atome Financial Singapore Pte. Ltd, Tokyo Century, Lippo Group, Lendable Ltd, Saison Capital, Quona Capital, Triodos Bank Germany

Government

OJK, Ministry of Cooperatives and MSMEs, Ministry of Finance, Ministry of Manpower, BP2MI, Ministry of Women Empowerment and Child Protection, Bank Indonesia

Multilaterals

Safe and Fair International Labor Organization (ILO)-UN Women, World Bank (WB)

Non-Profit

Serikat Buruh Migran Indonesia (SBMI), Asosiasi Sistem Pembayaran Indonesia (ASPI), Asosiasi E-commerce Indonesia (idEA), Asosiasi Fintech Indonesia (Aftech)

Public-Private Partnership

Pre-Employment Card Program is a work competency development program aimed at job seekers. GoI cooperates with e-wallets so that the recipients receive assistance directly through an e-wallet provided by the Partner without intermediaries or additional fees.

Target Locations

Indonesia: Countrywide

References

- (1) OJK. 2020. BAGAIMANA UMKM & PERBANKAN DAPAT SUKSES DI ERA DISRUPSI EKONOMI & DIGITAL. https://www.ojk.go.id/id/data-dan-statistik/research/prosiding/Documents/Kajian%20Bagaimana%20UMKM%20dan%20Perbankan%20Dapat%20Sukses%20di%20Era%20Disrupsi%20Ekonomi%20dan%20Digital.pdf

- (2) SOFIA-Oxford Policy Management Ltd. 2017. Understanding people's use of financial services in Indonesia. https://www.bappenas.go.id/files/e2017943-e9b8-4452-ae8a-5f7c86b4a814/download

- (3) OJK. 2021. THE INDONESIAN FINANCIAL SERVICES SECTOR MASTER PLAN 2021-2025. https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Pages/Master-Plan-Sektor-Jasa-Keuangan-Indonesia-2021-2025.aspx

- (4) Bamboo Capital Partner. 2020. Amartha – Bridging the financing gap for women entrepreneurs in Indonesia. https://bamboocp.com/amartha-bridging-the-financing-gap-for-women-entrepreneurs-in-indonesia/

- (5) WOMEN'S WORLD BANKING. 2019. Indonesia. https://www.womensworldbanking.org/country-strategies-indonesia/#keytrends

- (6) OJK. 2020. Supporting Financial Inclusion for MSMEs through FinTech. for https://ojk.go.id/id/berita-dan-kegiatan/publikasi/Documents/Pages/Financial-Inclusion-for-MSMEs-Through-Fintech/OJK%20Publication%20-Financial%20Inclusion%20for%20MSMEs%20through%20Fintech.pdf

- (7) Ayman Falak Medina. 2021. Opportunities in Indonesia’s Financial Technology Sector. https://www.aseanbriefing.com/news/opportunities-in-indonesias-financial-technology-sector/

- (8) J-PAL. 2020. Towards Inclusive Digital Finance in Indonesia (Inclusive Financial Innovation Initiative Whitepaper). https://www.povertyactionlab.org/review-paper/towards-inclusive-digital-finance-indonesia-inclusive-financial-innovation-initiative

- (9) PRAKARSA Policy Brief. 2020. The Risk of Over-indebtedness Amid COVID-19 Pandemic. https://responsibank.id/media/496087/policy-brief-23-eng-the-risk-of-over-indebtedness-amid-covid-19-pandemic.pdf

- (10) Liputan6. 2021. 51 Persen Penduduk Dewasa Indonesia Masih Belum Punya Rekening Bank. https://www.liputan6.com/bisnis/read/4502172/51-persen-penduduk-dewasa-indonesia-masih-belum-punya-rekening-bank

- (11) Ciptarianto, A. 2022. E-wallet application penetration for financial inclusion in Indonesia. International Journal of Current Science Research and Review. https://doi.org/10.47191/ijcsrr/v5-i2-03.

- (12) Bank Indonesia. 2020. INDONESIA PAYMENT SYSTEMS BLUEPRINT 2025. https://www.bi.go.id/en/fungsi-utama/sistem-pembayaran/blueprint-2025/default.aspx

- (13) OJK. 2021. Strategi Nasional Literasi Keuangan Indonesia (SNLKI) 2021 - 2025. https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Documents/Pages/Strategi-Nasional-Literasi-Keuangan-Indonesia-2021-2025/STRATEGI%20NASIONAL%20LITERASI%20KEUANGAN%20INDONESIA%20%28SNLKI%29%202021%20-%202025.pdf

- (14) CNBC Indonesia. 2018. 4 Tips Memilih Asuransi untuk Perempuan. https://www.cnbcindonesia.com/investment/20180312184304-21-7006/4-tips-memilih-asuransi-untuk-perempuan

- (15) SEKRETARIAT NASIONAL SDGS. 2019. Indonesia's SDG National Action Plans-RAN SDGs 2021-2024. https://sdgs.bappenas.go.id/category/dokumen/rencana-aksi-nasional-ran/.

- (16) Yudistra Nugroho, Ilham Samudera. 2018. All eyes on e-money: The race to reach 180M unbanked Indonesians. https://www.thinkwithgoogle.com/intl/en-apac/future-of-marketing/emerging-technology/all-eyes-e-money-race-reach-180m-unbanked-indonesians/

- (17) The Jakarta Post. 2021. Grab buys Tokopedia’s, Lippo’s shares in OVO. https://www.thejakartapost.com/news/2021/10/06/grab-buys-tokopedias-lippos-shares-in-ovo.html

- (18) Putu Agung Wija Putera. 2019. A new unicorn rises as OVO's $1bn valuation confirmed. https://www.compasslist.com/insights/a-new-unicorn-rises-as-ovos-1bn-valuation-confirmed

- (19) Yoolim Lee, Yudith Ho, and Manuel Baigorri. 2021. Grab Raises Stake in E-Wallet Ovo to 90%, Buys Out Tokopedia. https://www.bloomberg.com/news/articles/2021-10-04/grab-raises-stake-in-indonesia-s-ovo-to-90-buys-out-tokopedia#:~:text=Ovo%20is%20valued%20at%20about,named%20discussing%20a%20private%20deal

- (20) Fanny Potkin. 2020. Facebook, PayPal invest in Indonesian super app Gojek. https://www.reuters.com/article/us-gojek-funding-facebook-paypal-idUSKBN23A09Y

- (21) Statista. 2021. Largest banks in Indonesia as of Q1 2021, by total assets. https://www.statista.com/statistics/830681/indonesia-top-banks-by-total-assets/

- (22) Statista. 2021. Digital Payments. https://www.statista.com/outlook/dmo/fintech/digital-payments/indonesia.

- (23) Tempo.co. 2019. OVO Slams Bankruptcy Rumors; Posts 19-fold Revenue Increase. https://en.tempo.co/read/1284272/ovo-slams-bankruptcy-rumors-posts-19-fold-revenue-increase

- (24) OJK. 2020. Supporting Financial Inclusion for MSMEs through FinTech. for https://ojk.go.id/id/berita-dan-kegiatan/publikasi/Documents/Pages/Financial-Inclusion-for-MSMEs-Through-Fintech/OJK%20Publication%20-Financial%20Inclusion%20for%20MSMEs%20through%20Fintech.pdf

- (25) The Jakarta Post. 2021. Universitas Indonesia: GoPay drives financial literacy and deeper use of financial services. https://www.thejakartapost.com/ms/gojek-2019/2021/10/26/universitas-indonesia-gopay-drives-financial-literacy-and-deeper-use-of-financial-services.html

- (26) Statista. 2021. Digital Markets FinTech. https://www.statista.com/outlook/dmo/fintech/indonesia

- (27) IDNFinancial. 2020. GoPay recorded a total transaction value of US$ 6.3 billion. https://www.idnfinancials.com/news/31591/gopay-recorded-total-transaction

- (28) Ferrika Sari. 2021. Transaksi logistik OVO meningkat hampir 40%. https://industri.kontan.co.id/news/transaksi-logistik-ovo-meningkat-hampir-40

- (29) Fintech Indonesia. 2021. Fintech Corner-Edisi Spesial Kuartal II 2021. https://fintech.id/storage/files/shares/FINTECH%202021/Fintech%20Corner-Edisi%20Spesial%20Kuartal%20II%202021.pdf

- (30) Daily Social. 2019. Ovo CEO Jason Thompson talks company strategy, investments, and rumors. https://dailysocial.id/post/ovo-ceo-jason-thompson-talks-company-strategy-investments-and-rumors

- (31) Ken Research. 2021. Indonesia Online Loan and Insurance Industry Outlook to 2024 - Changing Landscape of Financial Products Distribution in Indonesia: Ken Research. https://www.globenewswire.com/news-release/2021/09/27/2303425/0/en/Indonesia-Online-Loan-and-Insurance-Industry-Outlook-to-2024-Changing-Landscape-of-Financial-Products-Distribution-in-Indonesia-Ken-Research.html.

- (32) Ken Research. 2020. Indonesia Online Loan and Insurance Industry Outlook to 2024 : Compelling Incumbents to pursue growth via Product Development & International Expansion. https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-online-loan-aggregator-industry-outlook/347119-93.html

- (33) Gojek. 2020. UN Women and Gojek team up for women’s economic empowerment. https://www.thejakartapost.com/ms/gojek-2019/2020/09/09/un-women-and-gojek-team-up-for-womens-economic-empowerment.html.

- (34) Leo Dwi Jatmiko. 2021. Mitra UMKM OVO Naik 95 Persen pada 2020. https://teknologi.bisnis.com/read/20210326/266/1373192/mitra-umkm-ovo-naik-95-persen-pada-2020.

- (35) The Jakarta Post. 2021. P2P lending: Setting new trends to reach MSMEs and women. https://www.thejakartapost.com/academia/2021/03/03/p2p-lending-setting-new-trends-to-reach-msmes-and-women.html.

- (36) Republic of Indonesia. 2021. Annexes Indonesia’s Voluntary National Review . https://sdgs.bappenas.go.id/laporan-voluntary-national-review-vnr-indonesia-2021/

- (37) World Bank. 2018. Global Findex database 2017. https://globalfindex.worldbank.org

- (38) ILO. 2019. Financing small businesses in Indonesia: challenges and opportunities. https://www.ilo.org/jakarta/whatwedo/publications/WCMS_695134/lang--en/index.htm

- (39) Indo Tekno. 2021. KoinWorks dukung partisipasi perempuan di industri fintech. https://www.indotelko.com/read/1615213445/koinworks-fintech

- (40) Dias Prasongko. 2019. OVO Slams Bankruptcy Rumors; Posts 19-fold Revenue Increase. https://en.tempo.co/read/1284272/ovo-slams-bankruptcy-rumors-posts-19-fold-revenue-increase

- (41) Program Keluarga Harapan. 2018. APA ITU PROGRAM KELUARGA HARAPAN. https://pkh.kemensos.go.id/?pg=tentangpkh-1

- (42) Satya. 2021. REGULATION OF DIGITAL PAYMENT SYSTEMS FOR INDONESIAN FINANCIAL SYSTEM STABILITY. https://berkas.dpr.go.id/puslit/files/info_singkat/Info%20Singkat-XIII-2-II-P3DI-Januari-2021-249-EN.pdf

- (43) Bank Indonesia. 2019. ECONOMIC REPORT ON INDONESIA 2019.https://www.bi.go.id/en/publikasi/laporan/Documents/7_LPI2019_CHAPTER5.pdf

- (44) Bank Indonesia. 2016. PERATURAN BANK INDONESIA NO. 18/40/PBI/2016 TENTANG PENYELENGGARAAN PEMROSESAN TRANSAKSI PEMBAYARAN. https://www.bi.go.id/id/publikasi/peraturan/Pages/pbi_184016.aspx

- (45) Badan Koordinasi Penanaman Modal. 2021. Pedoman dan Tata Cara Pelayanan Perizinan Berusaha Berbasis Risiko dan Fasilitas Penanaman Modal. https://peraturan.bpk.go.id/Home/Details/168903/peraturan-bkpm-no-4-tahun-2021